Uncontrolled spending burdens Montana taxpayers

Taxpayers had sticker shock last month as reappraisal notices hit mailboxes, detailing significant increases in property valuations and leaving many fearful of property tax hikes. While experts caution higher valuations don’t guarantee higher taxes, another factor is guaranteed to increase your tax burden: local governments growing their budgets.

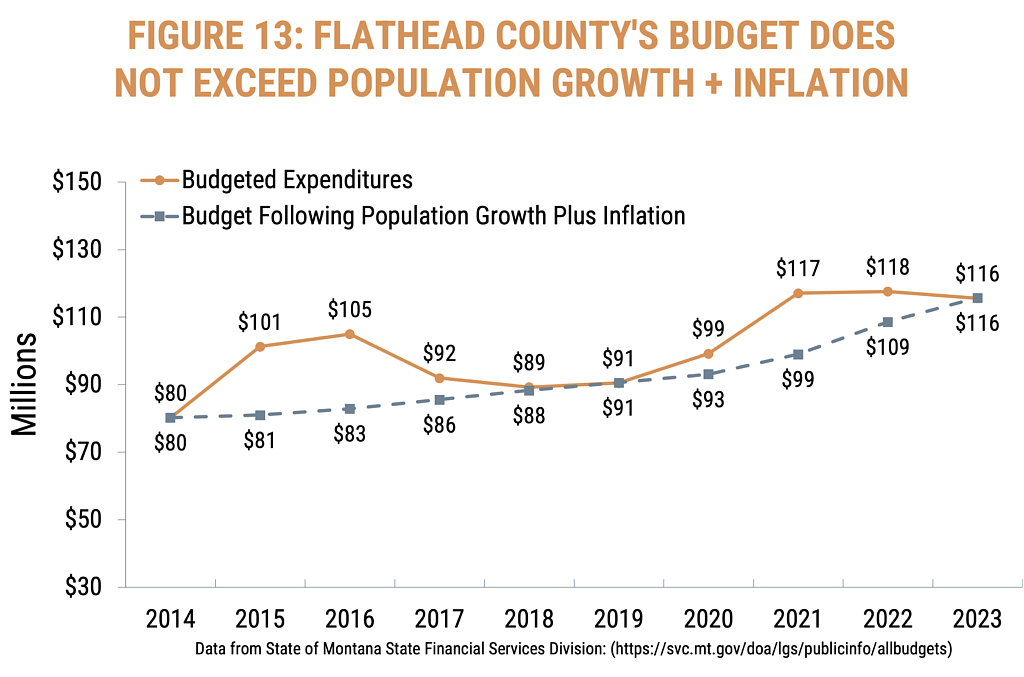

Frontier Institute’s newest Real Local Budgets report compares budget growth for major cities and counties over the last decade to the rate of population growth plus inflation, a benchmark metric for fiscally conservative budgeting. The report once again finds most major local governments continued a spending spree last year, burdening Montana taxpayers with hundreds of millions in excessive spending.

The cities of Missoula, Bozeman and Kalispell have each more than doubled their budgets since FY 2014, outpacing population growth plus inflation by a combined average 95%. Yellowstone, Gallatin and Missoula top the county spenders since FY 14, growing past population growth plus inflation by an average 41%.

If budgets were really only rising to accommodate population influx and inflation, as many local leaders claim, they would be much lower.

Taxpayers should be wary of a local government spending binge. Spending growth always must eventually be paid for by the taxpayer in the form of higher property taxes, assessments, fees or something else.

Montana does place some statutory limits on property tax collections, capping the growth of property tax revenues and requiring a vote to exceed the growth limit, which provides some protection for taxpayers when local leaders go on a budget splurge. However, local governments find creative ways around these limits in order to squeeze property owners.

For example, Helena City Commissioner Sean Logan recently called attention to a resolution renewing an assessment to fund the city’s urban forestry program. Logan opposed the proposal, saying that the assessment was in reality a tax that by state law should go to voters for approval.

Commissioner Logan makes an important point. Special assessments are different than property taxes, at least in theory. A tax is levied for the general public good while an assessment is imposed against a specific property to cover the cost of a specific benefit to the property. This nuance means special assessments and other “non-tax” fees are not limited by law the same way property taxes are. This unfortunately makes such fees a prime tool for raising additional revenue from property owners to meet the insatiable spending needs of some local budgets.

In another example, while the City of Bozeman’s proposed FY 2024 budget calls for a 4.2% decrease in property taxes, once increases in assessments and other fees are factored in the typical household will be stuck with a 2.8% overall increase in what they owe the government.

A more robust cap on the growth of property tax collections might help provide some additional relief to existing homeowners and businesses, but it won’t solve the underlying spending problem in many communities because local governments will simply target property owners with special assessments, fees or some other revenue gimmick to fund increased budgets.

One solution is to impose a statutory limit on the growth of local government expenditures. In fact, the state budget is already limited by such a cap, with state law limiting spending increases to no more than the average growth of Montana total personal income. Local governments, meanwhile, face no expenditure cap and clearly have little incentive to keep spending growth in check. For the sake of Montana taxpayers, this imbalance between state and local government budgeting should be corrected in the next legislative session.

Kendall Cotton is president and CEO of the Frontier Institute, a think tank dedicated to breaking down government barriers so all Montanans can thrive.